Innovation

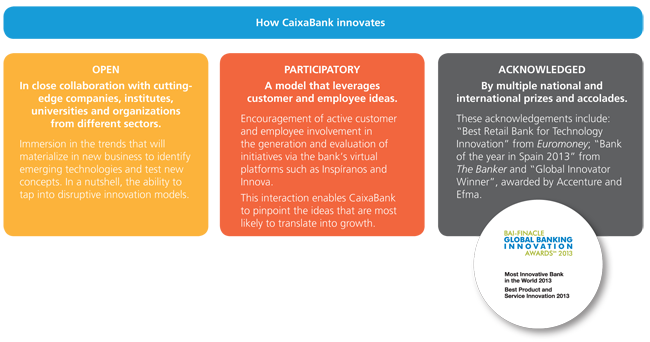

CaixaBank views innovation as the means to raising customer service standards and generating new sources of income by anticipating changes in society and emerging technologies.

The following is crucial to delivery of this dual objective:

-

Analysis of external trends: study of changes emerging in society and on the technology front enables the early detection of new business opportunities and trends that will ultimately shape new business models.

-

Feedback from employees and customers: their ideas and suggestions help to continually improve processes and products and, by extension, the service standards offered.

CaixaBank partners with other organizations and entities to identify emerging technologies, trends that are of interest to the financial sector, allowing it to develop new business models.

In 2013, attention turned to customer and employee mobility, social networking technologies, data management to improve decision-making, process digitalization and automation, and shifts in customer relations.

The ”la Caixa” - IBM Digital Innovation Center works on the latest technologies, research capabilities and business process developments with a view to increasing the value of CaixaBank's business. CaixaBank also partners with Oracle in the Big Data field to streamline the decision-making process and develop new products and services through mass data management.

The third edition of FinAppsParty was hosted, during which awards were given to the best ideas for mobile phone apps in the areas proposed by CaixaBank. 37 projects were submitted by 46 teams, involving 122 participants.

CaixaBank's innovation model encourages collective intelligence and co-creation. Customer and employee involvement is therefore critical.

-

Inspíranos [Inspire us] for customers: an innovation community based on Web 2.0 technology that is open to all internet banking users. Customers can send CaixaBank their proposals for new products and services, and evaluate other users' contributions. There were over 140,000 visits in 2013, with 1,275 contributions submitted.

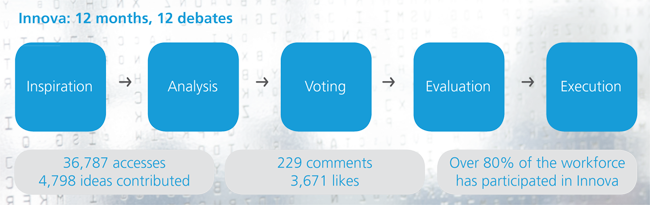

- Innova, for employees: an in-house portal providing tools and instruments for staff to share ideas and knowledge. The portal has several sections:

– Tus ideas suman [Your ideas count], where proposals on a specific theme are collated. Staff can work in a team to execute a project (Challenges area) or trial and comment on new products before they are launched (Product-testing section).

– Suggestions Box collects ideas for how to do better, sent in spontaneously by employees. In 2013, 6,632 ideas were received, 533 of which have been slated for implementation.