Profit/loss

Net profit for the Group stood at €503 million (+118.9% vs 2012), affected by high levels of recurring banking income, the major provisioning and write-down effort, and gains on corporate events.

Earnings were also affected by the mergers of Banca Cívica (as from July 1, 2012) and Banco de Valencia (as from January 1, 2013).

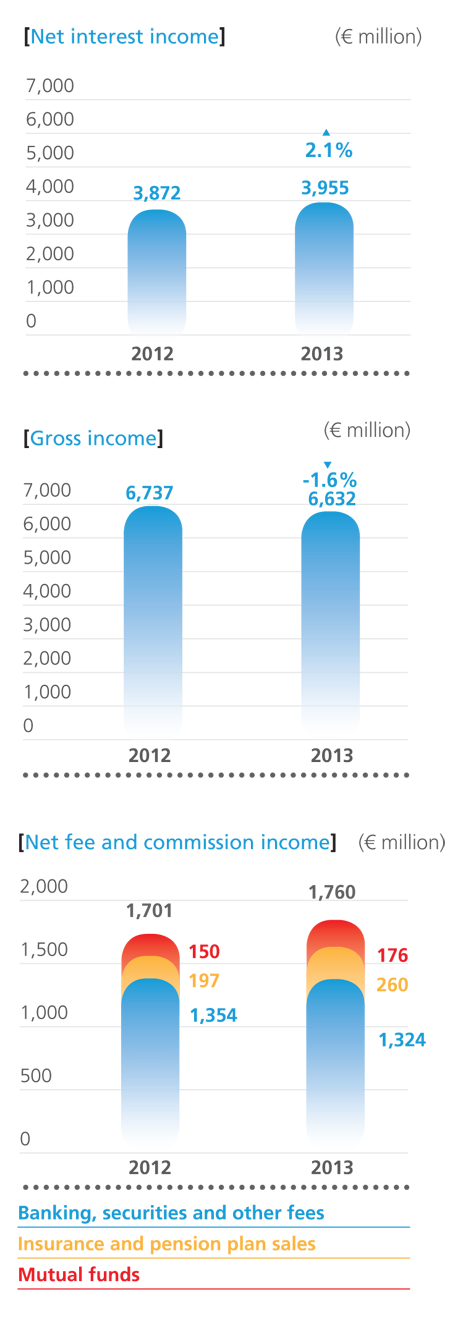

- Net interest income is up 2.1% to €3,955 million. Performance was characterized by higher margins on new transactions and active management to reduce financing costs, which offset the impact of repricing of the mortgage portfolio, deleveraging and customer arrears.

- Fee and commission income was sustained, totaling €1,760 million (+3.5% in 2013), underpinned by higher business volume managed and the bank’s commercial strength. The increase in fee and commission income resulting from the management of off-balance-sheet funds is most noteworthy.

- Lower contribution from investees: decreased dividends and attributable results.

- Gains on financial assets and liabilities and exchange rate gains totaling €679 million in 2013.

- On a like-to-like basis*, recurring operating expenses declined by 6.4%, as a consequence of the intense efforts to optimize the Group's structure and the completion of the key milestones in the integration of Banca Cívica and Banco de Valencia.

- Work is being stepped up to unlock synergies that guarantee cost savings: synergies totaling €436 million were captured, 156% of the target announced for 2013.

- Total operating expenses also reflect the recognition in 2013 of non-recurring costs of €839 million, primarily derived from the CaixaBank personnel restructuring agreement. Stripping out non-recurring costs, pre-impairment income was €2,685 million (down 16.6%).

- Impairment losses on financial assets and other increased by +9.8% to €4,329 million in 2013. These included major write-downs to comply with additional regulatory requirements: application of new criteria for refinanced transactions, and full compliance with the provisioning requirements for loans to the real estate sector as set out under Royal Decree Law 18/2012.

- Significant write-downs to cover foreclosed assets, €665 million.

- Gains on corporate actions: acquisition of Banco de Valencia, and sale of 51% of the real estate business; sale of the non-life insurance business of Banca Cívica and Banco de Valencia to SegurCaixa Adeslas; and sale of part of the stake in Grupo Financiero Inbursa.

*Pro-forma, including Banca Cívica and Banco de Valencia as of January 1, 2012.