Risk management

Change in trend of distressed assets

- Non-performing assets fell €511 million during the second half of the year.

- The NPL ratio (11.66% at December 31, 2013) has primarily been affected by deleveraging, application of new criteria for classifying refinanced transactions, and the integration of Banco de Valencia. Stripping out the effect of the real estate development sector, the NPL ratio stands at 6.83%.

- The portfolio of foreclosed real estate assets available for sale stands at €6,169 million, having fallen €158 million in the fourth quarter.

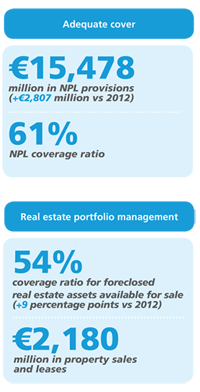

- The major marketing drive pushed up the number of properties sold or leased to €2,180 million (+119.1% vs 2012).

Balance sheet write-downs with appropriate coverage

- In 2013, CaixaBank recognized allowances and write-downs totaling €7,501 million.

- Loan loss provisions reached €15,478 million (+€2,807 million vs 2012), with a coverage ratio of 61%.

- The coverage of foreclosed real estate assets available for sale was 54%, 9 percentage points higher than in 2012 following major write-downs.