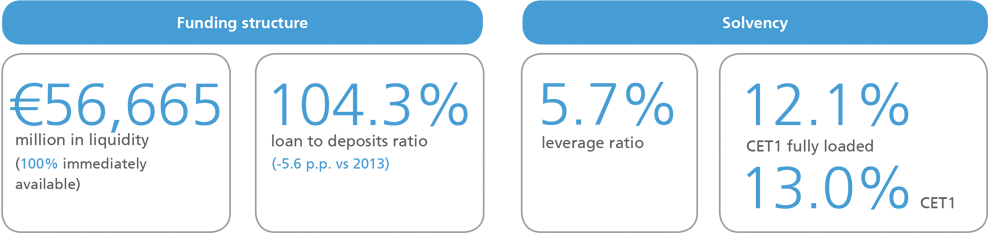

At 31 December 2014, banking liquidity stood at €56,665 million, all of which was immediately available (16.7% of Group assets). The loan-to-deposits ratio improved 5.6 percentage points to 104%, reflecting the solid structure of retail financing.

In 2014, the bank repaid, in advance of the maturity schedule, all ECB LTRO financing (€15,480 million). During the year, the bank received €6,868 million under the ECB's new targeted longer-term financing operation (TLTRO).

In 2014, the bank successfully passed the asset quality review (AQR) and stress test conducted, at the ”la Caixa” Group level, by the European Banking Authority (EBA). Applying the same assessment to CaixaBank under the adverse scenario, internal estimates resulted in surplus capital of €7,706 million and a Common Equity Tier 1 (CET1) ratio of 10.3%.

One of the Group's top priorities is to ensure that capital is fully optimised. In that regard, the bank's ability to generate capital pushed its CET1 ratio up by 112 basis points in 2014. At 31 December 2014, CET1 BIS III stood at 13.0%. This means a surplus of €11,807 million, of the highest-quality capital.

Risk-weighted assets stood at €139,729 million.

The Tier Total figure came in at 16.1%, which was €11,272 million higher than the regulatory minimum.