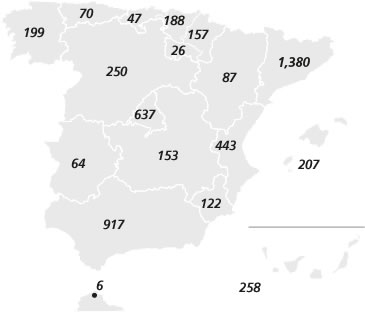

9,631 ATMs

EXTENSIVE REACH

Present in 100%

of towns with over 25,000 inhabitants.

Present in 99.5%

of towns with over 10,000 inhabitants.

86% of branches are accessible.

CaixaBank's banking and financial tradition spans an entire century, with a unique management model which has helped it become a benchmark institution in the European banking sector. It is the leading bank in Spain, with a large customer base (one in four Spaniards banks with CaixaBank) and the financial system's largest commercial network.

CaixaBank stands out for its financial strength, its vocation for forging close ties with communities and its proven innovative ability. It focuses on the quality of service and profitability while upholding its unyielding commitment to society. It therefore strives to maximise wealth generation and employment, cultivating a relationship of trust, maintaining its staunch social commitment and collaborating in moving towards a low-carbon economy.

1 in 4 customers uses CaixaBank as its main bank.

€344,255 M total assets.

It boasts the largest number of active digital customers in the country:

4.8

million

4.8

million

online customers

2.8

million

2.8

million

mobile customers

The most intensive branch network in Spain

5,211 branches

9,631 ATMs

EXTENSIVE REACH

Present in 100%

of towns with over 25,000 inhabitants.

Present in 99.5%

of towns with over 10,000 inhabitants.

86% of branches are accessible.

Using both quantitative and qualitative data, this report highlights CaixaBank's positive impact in the regions where it operates and its role as one of the economy's key agents. It focuses on the following key areas:

Its contribution to the economy in terms of GDP and public finance, income and jobs created and support for the production sector.

CaixaBank's position as a reliable banking institution, which is borne out by its extensive customer base, its strong balance sheet, the integrity and experience of its emloyees, the priority given to the security of its customers and employees and its initiatives to educate the population in financial matters.

The initiatives it promotes to encourage financial inclusion, long-term savings and retirement planning: providing access to housing and promoting the Welfare Projects of "la Caixa" Banking Foundation as well as corporate volunteering.

Its active role in combating climate change through its products and services, reducing its carbon footprint and its participation in various national and international initiatives promoting environmental sustainability.

Unless otherwise stated, the data in this report refer to 2015 and include the impact of CaixaBank and its subsidiaries, where applicable and where information is available.

The indicators and other information in the report are based on the Entity's own calculations using internal data and databases and external reports. This is stated where relevant.

The non-financial information included in this report was verified by Deloitte, in accordance with the terms expressed in its independent assurance report. The economic and financial information was obtained from CaixaBank Group's audited 2015 financial statements. Both documents are available on the company's website.