13.8 M customers

1 in 3 young people (between 18 and 35 years)

28.5% of the over 65s

1 in 4 people

have their salary paid into a CaixaBank account.

1 in 5 senior citizens

receive their social security pension via CaixaBank.

CaixaBank has inherited a century-old financial tradition and strives to strengthen its reputation as a paradigm of a responsible bank. Based on heritage values, it works to establish a relationship of trust with society based on the professionalism and integrity of its employees, responsible management of the business and close ties and responsibility with the regions where it is present.

CaixaBank is the market leader in Spain with a 24% share among individual customers who make it their main bank.

1 in 4 people

have their salary paid into a CaixaBank account.

1 in 5 senior citizens

receive their social security pension via CaixaBank.

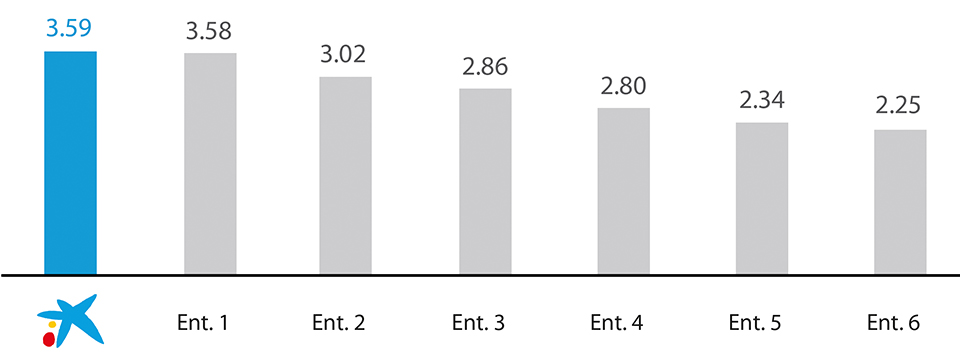

CaixaBank has the most net supporters among its customer base.

CaixaBank has the most net supporters among its customer base.

CaixaBank has one of the largest capital buffers of the Spanish banks as per the ECB's minimum capital requirements.

Everyone who works at CaixaBank must adhere to the Code of Business Conducts and Ethics, the Anti-corruption Policy and other internal conduct regulations covering specific areas (for example the securities market, contributions to the Euribor, anti-money laundering and counter terrorist financing).

The internal whistle-blowing channel ensures employees comply with these.

Complaints by customers and other stakeholders are handled through the normal customer service channels.

94% of staff completed the ethical conduct and anti-corruption policy course.

CaixaBank’s 2015 Corporate Social Responsibility Policy published.

CaixaBank integrates ethical, social and environmental values in all decisions it takes.

All contracts signed by the Group's suppliers include clauses concerning compliance with ethical, environmental and social conduct.

Adheres to international corporate responsibility initiatives such as the UN Global Compact, the UN's Women's Empowerment Principles and the Equator Principles.

In 2015, it adhered to the Code of Best Practices published by the Spanish tax authorities.

CaixaBank has a Transparency Committee which ensures all transparency-related aspects of the design and marketing of financial instruments, banking products and savings and investment plans.

All products for individual customers have information sheets on the related characteristics and risks.

Customers receive these information sheets before signing up for the product in question.

CaixaBank has a Commercial Communication Policy to ensure all its advertising is transparent, responsible and complies with prevailing legislation.

CaixaBank is one of the entities which most frequently decides to rectify information, accepting the findings of the Bank of Spain's reports, which are not binding for the entity. This is clearly above the sector average*.

Most responsible financial entity and best corporate governance according to Merco Responsabilidad y Gobierno Corporativo 2015.

Most responsible financial entity and best corporate governance according to Merco Responsabilidad y Gobierno Corporativo 2015.

CaixaBank invests in its employees' abilities to maximise the quality of the service supplied.

Its Business Banking professionals are AENOR certified (2015)

Its Business Banking professionals are AENOR certified (2015)

New CaixaBank Risks School working with the Pompeu Fabra University (UPF), the Institute of Stock Market Studies (Instituto de Estudios Bursátiles - IEB) and the Universitat Oberta de Catalunya (UOC).

Some 1,900 employees were awarded the first Risks Analysts Certificate and the Postgraduate Retail Risk Analysis Diploma - specialising in retail.

4,800 employees at CaixaBank Group are taking the Postgraduate course in Savings and Retirement given by the Universidad Pompeu Fabra and the Barcelona School of Management.

€11.4 M invested in training

48.9 hours of training per employee.

100% of customer-facing employees are trained.

European Model of Excellence in Management +600 EFQM

European Model of Excellence in Management +600 EFQMCaixaBank actively contributes to increasing the population's knowledge of the basic concepts of the economy and finance.

for vulnerable groups given by trained teachers and social workers with the support of volunteers from the entity.

1,667 attendees

100 volunteers

31 social entities

collaborators

on the economy and finance

1,036 attendees

The bank's research department compiles information and spreads this both within and outside the entity.

252,000 mail shots

of the Monthly Report

95,000 newsletters

sent by email

465 articles published

1,500 people attended the classes and conferences given by ”la Caixa” Economy and Society Chair

112,000 visits to www.caixabankresearch.com

Information on the bank, its customers and employees is protected against any internal or external security threat.

Largest number of active digital customers in the country.

Largest number of active digital customers in the country. 31.9% of online bankers in Spain are CaixaBank customers.

Over 27.6million SMS alerts sent.

Over 27.6million SMS alerts sent.