Corporate Report

- CaixaBank in 2013

-

Letters

-

About us

-

Corporate governance

-

Key strategies

-

Financial reporting and results

- Active risk management

-

Business model

-

Corporate culture

-

Commitment to people and society

-

Download center and services

-

DOWNLOAD

- Summary ReportPDF Version

- Full VersionPDF Version

Integrated Corporate Report 2013

- LIBRARY

- Videos

- Accessibility

- Share

- MORE INFORMATION

-

DOWNLOAD

CaixaBank provides services to 13.6 million customers, with total assets of €340,190 million. The strength of the branch network and completion of the integration of Banca Cívica and Banco de Valencia helped to bolster CaixaBank's market presence and resulted in growth targets being hit ahead of schedule. Consequently, gains in market share in all the main retail banking products and services were achieved.

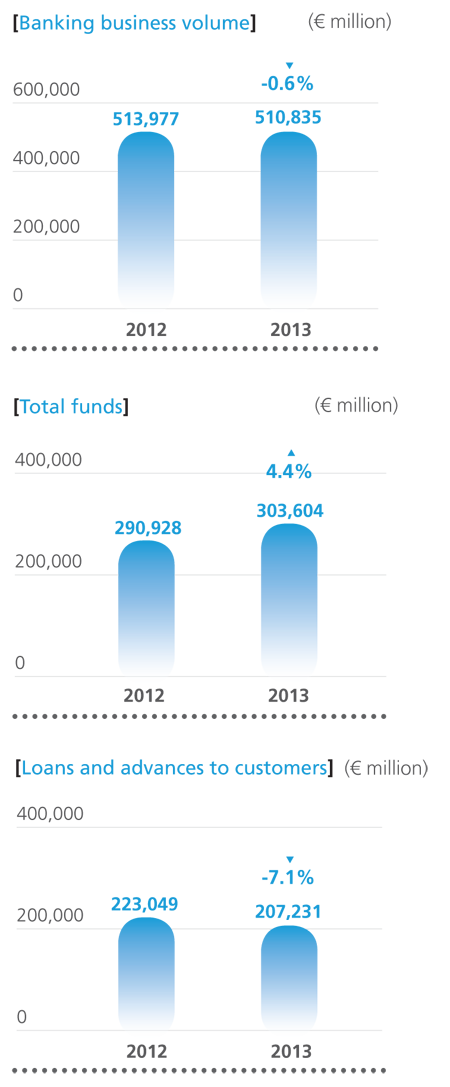

Business volume stood at €510,835 million: total customer funds of €303,604 million (+4.4% in 2013) and a lending portfolio of €207,231 million (-7.1% in 2013). The 6.9% growth in customer funds is a highlight, and significantly diversified among the different savings products. The change in the loan portfolio is mainly due to widespread deleveraging and a reduction in exposure to the real estate development sector.