Internationalization and diversification of revenue

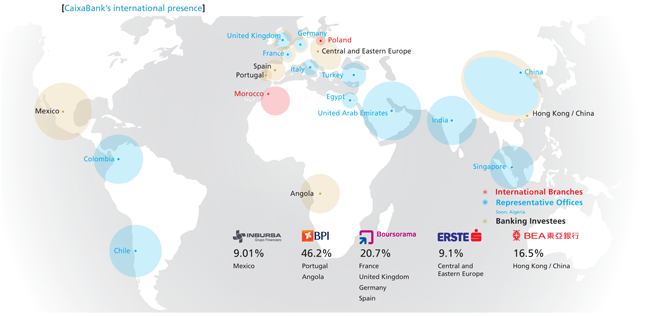

International diversification is one of CaixaBank's core strategic targets. This strategy is being articulated around a direct presence in the form of banking branches and representative offices; and strategic alliances with leading investee banks and long-term relationships with multilateral agencies and central banks.

CaixaBank has strategic investments in five major banking groups in Europe, China and Mexico in order to offer shareholders and investors preferential access to new business opportunities in high-growth regions with a balanced risk profile. These financial groups, with combined assets of over €335,000 million, also help CaixaBank customers with their business interests abroad.

Moreover, CaixaBank maintains a proprietary branch network in different countries, through which it provides specialized support for customers with trade dealings outside Spain. In 2013, it opened representative offices in Chile (Santiago de Chile) and Colombia (Bogotá). Where it does not have a direct presence or indirect presence through partner banks, CaixaBank has a network of over 2,900 correspondent banks.

In order to diversify its sources of income, CaixaBank holds equity interests in Repsol (12.02%) and Telefónica (5.37%), both leading companies in their respective sectors, which offer growth and value stories as well as a strong international presence.