CaixaBank has kept up its efforts to help boost business productivity, create new jobs and enhance living standards.

Self-employed professionals and businesses

- 32.5% of Spanish companies and 31.3% of self-employed workers are CaixaBank customers. For both groups, the bank has designed a wide range of customised products and services.

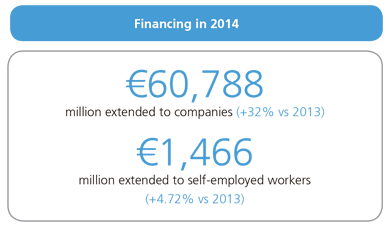

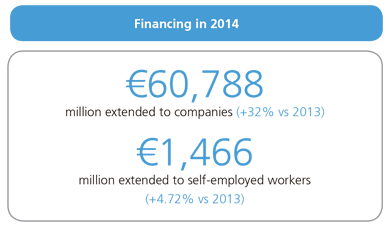

- The bank launched its Investment Stimulus Plan to help meet the demand for credit among companies (new loans, credit account, syndicated loans and variation in the commercial loan portfolio: +26% vs 2013).

MicroBank

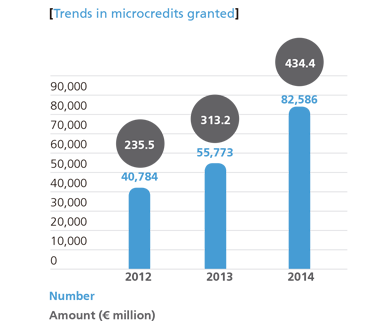

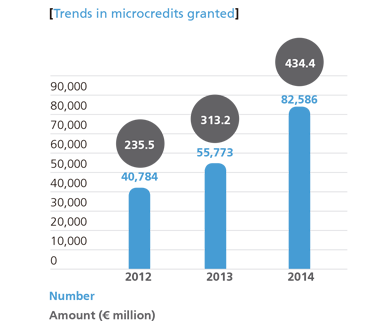

MicroBank, the Group's social banking arm specialised in microfinance, serves those population segments whose financial needs are not generally covered, whether they are entrepreneurs, microcompanies or individuals.

- 18,527 microcredits extended to entrepreneurs in 2014, totalling €205.1 million (+21% vs 2013).

- Each company funded through a microcredit creates 1.81 new jobs, on average.

- Since 2007, MicroBank has contributed to creating or safeguarding over 134,821 jobs.

Encouraging innovative ideas

- Caixa Capital Risc manages seven private equity companies, primarily funded by the ”la Caixa” Group, investing a total of €144 million in the start-up of Spanish companies with high growth potential.

- Among other initiatives to foster innovation and talent, the bank holds the EmprendedorXXI Prizes each year, recognising 40 companies in 2014.