CaixaBank provides services to 13.4 million customers, with total assets of €338,623 million.

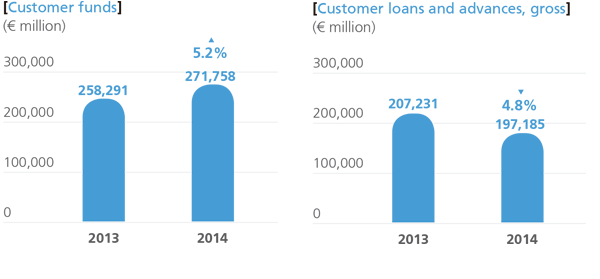

In 2014, customer funds grew by €13,467 million (+5.2% vs 2013), to reach €271,758 million. Trends in on-balance sheet funds were impacted by the management of margins on new transactions and the channelling by customers of funds from savings products to off-balance sheet products on maturity. To that end, the bank offers customers a diversified range of products tailored to each customer segment.

Customer loans and advances, gross stood at €197,185 million. The decrease in 2014 (-4.8% vs 2013) was primarily due to the widespread deleveraging in the system, reduced exposure to the real-estate sector (-29.6% vs 2013) and management of NPLs. Stripping out loans to real-estate developers, the drop stood at just 1.7% for the performing portfolio. Diversification is one of the key strengths of CaixaBank's portfolio, 73% of which is dedicated to retail financing (individuals and SMEs).