BUSINESS MODEL

CaixaBank is the leading bank in Spain thanks to a universal banking model predicated on the provision of high quality, friendly and specialised service, with a wide range of products and services that are adapted to customers‘ various needs and an extensive multi-channel distribution network. The Bank has also formed strategic alliances with investee banks and has shareholdings in companies in the service sector.

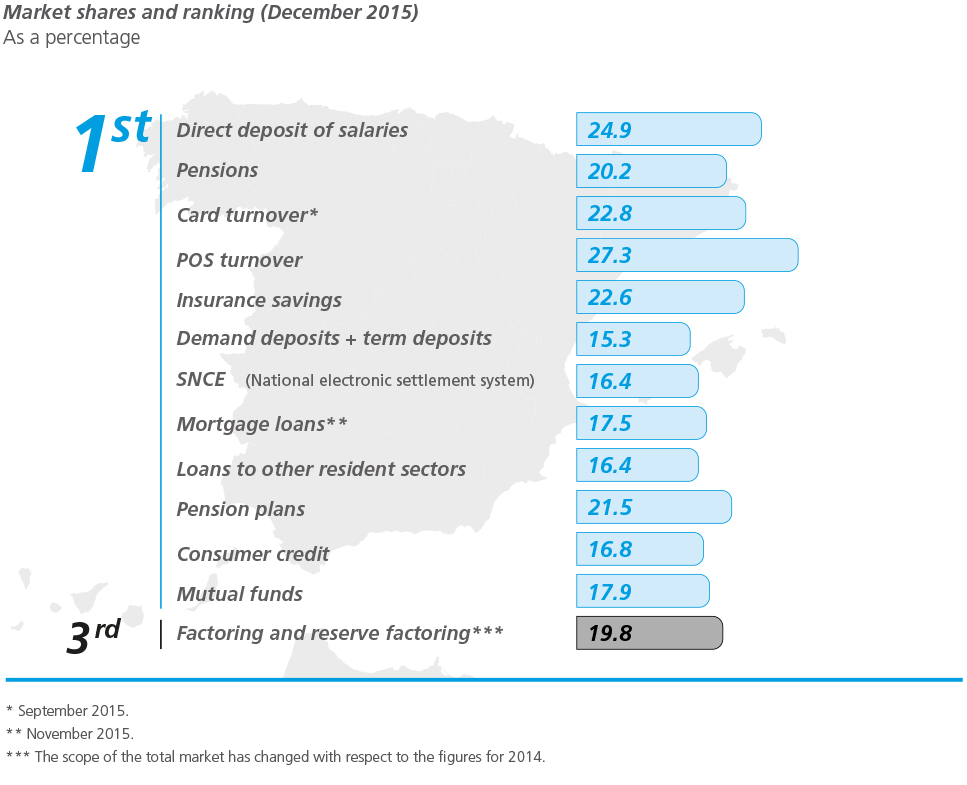

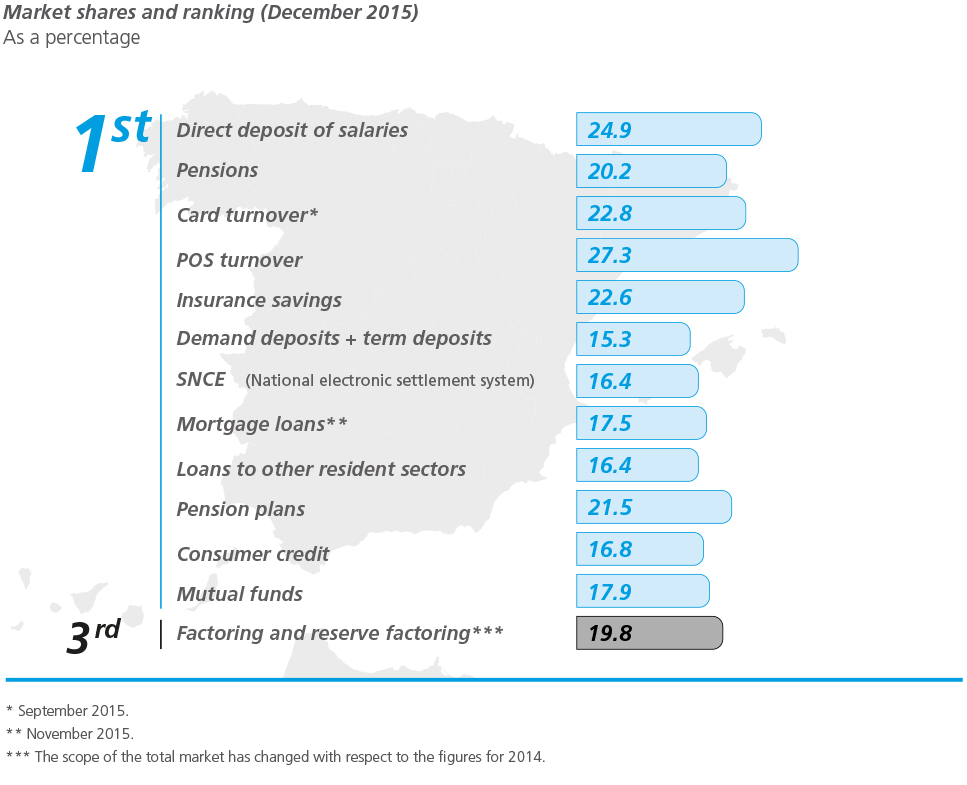

A LEADING GROUP

One in every four Spanish banking customers has placed its trust in CaixaBank.

Market share of customers

28.3%

Individuals

> 18 years

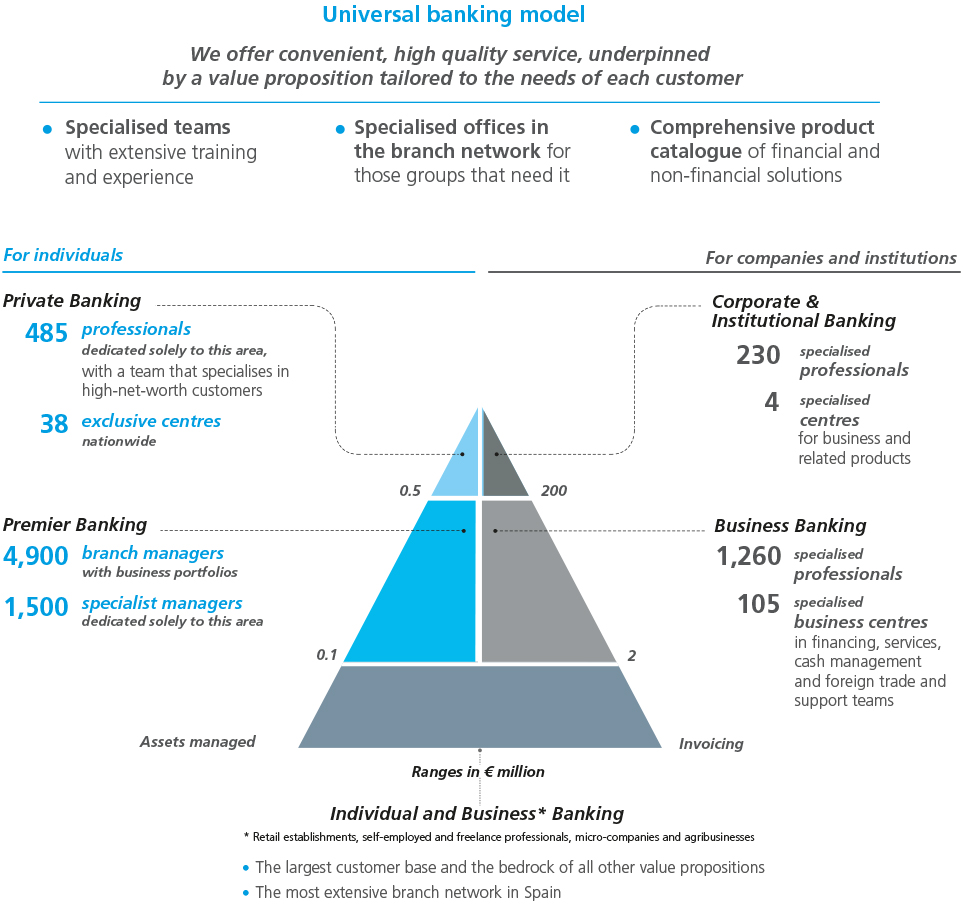

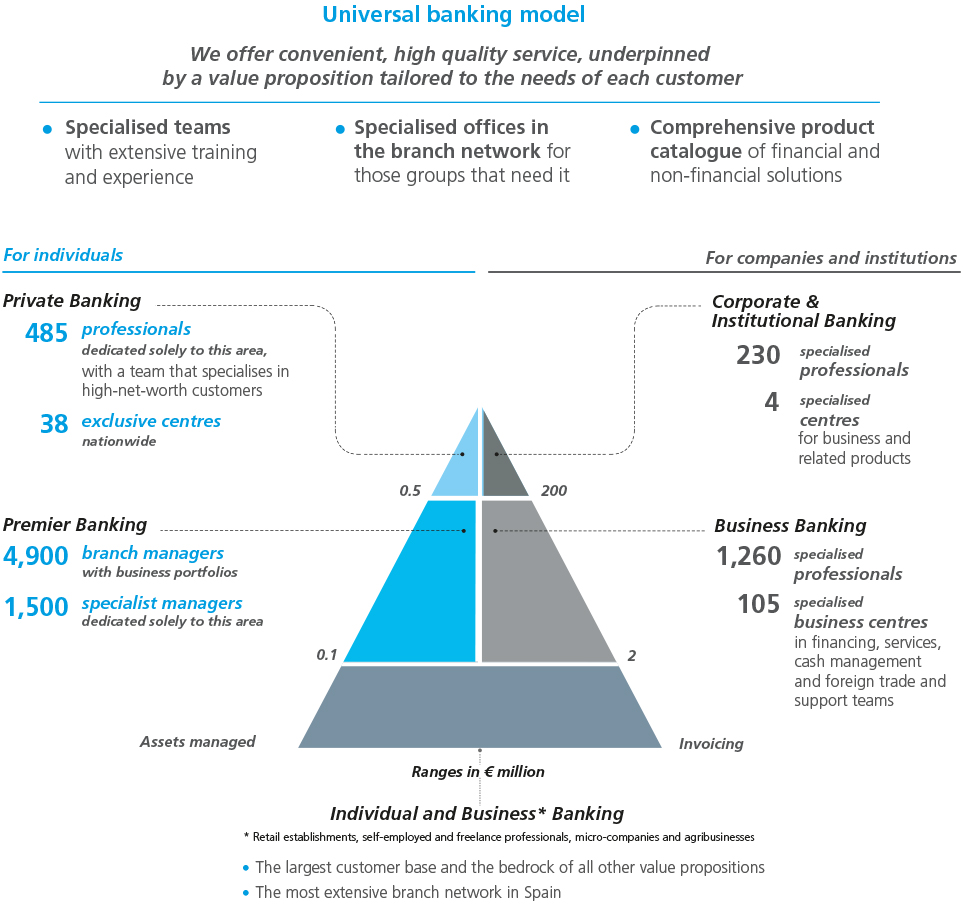

SPECIALISED MANAGEMENT

Individual and Business Banking

Individual and Business Banking

Individual and Business Banking

With a high-quality multi-channel approach, this value proposition offers easy and convenient solutions through a unique and clear-cut offer.

In 2015, the focus with regard to Individual Banking was on:

- Bringing in salary direct deposits, with 782,000 new salaries directly deposited, thanks to the commercial effort in an environment where the employment market is recovering.

- Stronger customer loyalty through the launch of new products and services (such as mortgages with fixed and mixed interest rates; long-term systematic savings products and tax advantages; multi-year car insurance and the protection map), the ease of obtaining consumer loans and new developments in payment methods with CaixaBank Pay.

- The launch of HolaBank, a value proposition designed for foreign customers who reside in Spain for part of the year; it has a unique branch network, multilingual employees and specialised products.

The value proposition CaixaNegocios, launched in 2014, was consolidated and is aimed at self-employed professionals and small enterprises that bill less than €2 million.

- More than 1,600 managers are dedicated solely to this area and provided with mobile devices that allow them to bring the branch to the customer. In 2015 the Business Wall was launched, a new channel for exclusive communication between customers and managers.

- 308,800 new businesses were captured (up 23% on 2014) and the product portfolio was completed with new developments such as the multiSeguros pack, with discounts depending on the level of protection and how long you have had the pack, the POS tablet and other sector-specific solutions for the hospitality, tourism, pharmacy, office and food industries.

2015 was the first full year for the AgroBank line of business, which is aimed at agrarian

customers and has 576 specialised offices.

- The business reached 330,000 customers (+47,000 new customers vs. 2014) and its turnover increased by 5% to €15,118 million.

- Innovative products were launched, such as AgroConfirming, and the actions driving the sector, such as agreements, seminars, participation in trade fairs and awards, were strengthened.

For additional information

11.77

Individual customers

million

1.39

Business customers

million

111,210

Investment

million €

84,474

Funds under management

million €

INSURANCE AND PENSION PLANS COMPLEMENT THE BANKING BUSINESS

VidaCaixa (100% CaixaBank):

No. 1 in life insurance

No. 1 in pension plans

SegurCaixa Adeslas (49.9% CaixaBank):

No. 1 in health insurance

No. 2 in homeowners insurance

No. 5 in multi-risk insurance

Premier Banking (in Spanish)

Premier Banking (in Spanish)

Premier Banking (in Spanish)

A new value proposition for consolidating our leadership in financial advisory services, thanks to our own financial planning model, professionals with certified training and exclusive conditions for customers.

Launch of CaixaBank‘s new brand: Premier Banking.

Our leadership position in the premier banking segment was consolidated following the integration of Barclays Bank, SAU.

The bank continues to build on the skills of its team through the post-graduate degree programme in Financial Advising of the Universidad Pompeu Fabra (UPF) and the international certificate programme of the Chartered Institute for Securities & Investment (CISI).

The bank will continue to strengthen its advisory services in 2016 in order to increase the diversification of its savings, investment and retirement portfolios. Another goal, as a result of its commitment to excellence and quality service, includes renewing its AENOR certificate in financial advisory services.

For additional information

104,480

Customer funds and securities under management

million €

Private Banking

Private Banking

Private Banking

This value proposition focuses on the customers‘ goals, making a team of professionals, along with the network of branches, available to assist customers in taking decisions regarding their assets using a unique methodology.

Recognition such as the “Best Private Banking Services in Spain” and the “Best entity in philanthropic and investment services in Spain” according to Euromoney.

The Value Groups and Philanthropy Department was created, which entered into over 80 agreements with strategic groups for private banking customers and prepared a specific social value proposition.

The integration of the managers from Barclays Bank, SAU consolidated Private Banking as one of the largest teams in the country, with 485 qualified professionals with an average of 15 years of experience.

In 2016 the bank will continue with its commitment to the ongoing training of its professionals and to investing in technology to fulfil customers‘ needs.

For additional information

58,050

Customer funds and securities under management

million €

Business Banking

Business Banking

Business Banking

The purpose of this specialised line of business is to establish a long-term relationship with companies, underpinning their growth and day-to-day management. To do this, we have a simple and clear value proposition with a quality service that has been certified externally.

The first and only European bank to obtain the AENOR Conform quality certification for corporate banking advisory services, which guarantees an optimal level of management and customer service.

In 2015 seven new business centres were opened in Barcelona (three), Bilbao, Valencia, the Balearic Islands and Girona.

14 real estate business centres were also created to lead the recovery of the transformed developer business and to become a financial benchmark in the sector.

The Investment Stimulus Plan (ISP) continues to respond to companies‘ demand for loans to be able to grow and expand internationally.

For additional information

33,707

Investment

million €

18,186

Funds under

management

million €

Corporate & Institutional Banking

Corporate & Institutional Banking

Corporate & Institutional Banking

Wholesale banking offers personalised service for more than 500 commercial groups of customers for the purpose of becoming a benchmark entity and anticipating their needs. Personalised value propositions have therefore been designed and customers operating abroad are able to take advantage of CaixaBank‘s international business.

The Corporate & Institutional Banking (CIB) division was created in 2015, which integrates Corporate Banking, Institutional Banking and other areas that provide service to customers, such as Treasury and Capital Markets. The division also supports the bank‘s other value propositions.

Throughout the year, and despite the sharp increase in competition both in Spain and abroad, the bank reached its investment and ordinary income targets. In addition, its risk-adjusted returns improved and its capital consumption was adjusted.

In 2016 the bank will continue to work towards obtaining a greater share of and weight in the market through risk-adjusted growth that is gradual, sustainable and profitable.

29,739

Investment

million €

22,885

Funds under management

million €

A DIVERSIFIED BUSINESS

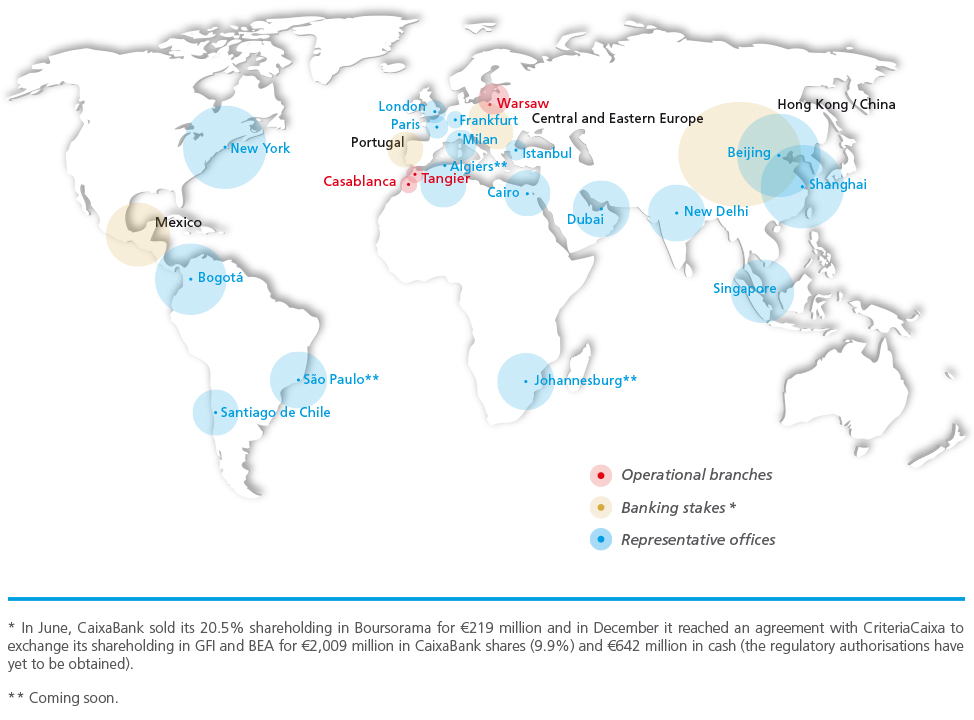

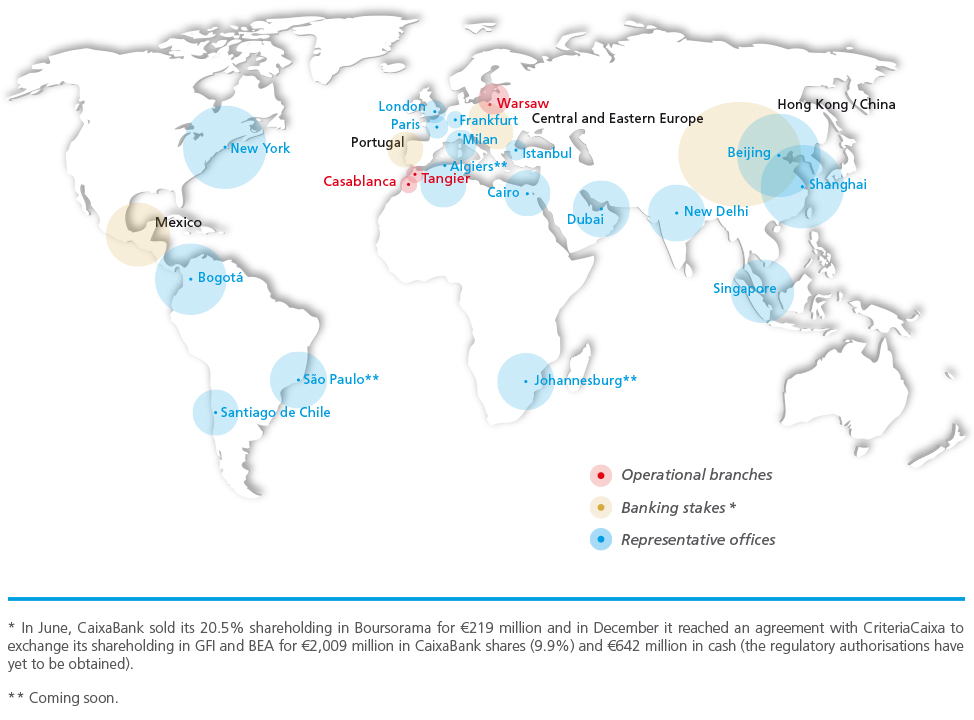

CaixaBank's international presence

Operational branches

Offer financing and financial services to Spanish companies with interests and activities in these countries, as well as to local businesses.

Representative offices

Advisory services for European multinationals with subsidiaries in Spain, and for Spanish companies doing business abroad. Coming soon: Algiers, São Paulo and Johannesburg.

Banking stakes

Strategic alliances with four major banking groups* offering preferential access to new business opportunities in emerging regions, and that help CaixaBank customers carry out their business abroad.

CaixaBank rounds out its own service with a network of over 2,900 correspondent banks.

Revenue diversification

CaixaBank holds equity interests in two leading companies in their respective sectors, which offer growth and value stories as well as a strong international presence.

For additional information

PDF

PDF

Microsite

Microsite

The Principles of the UN Global Compact covered in the page are:

The Principles of the UN Global Compact covered in the page are: