CAIXABANK IN 2015

STRATEGIES

LINE 1 -QUALITY AND REPUTATION

Objectives and milestones

Objectives and milestones

LINE 2 - RECURRING RETURNS

Objectives and main milestones

Objectives and main milestones

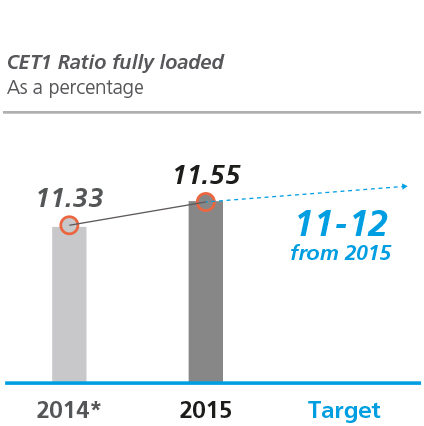

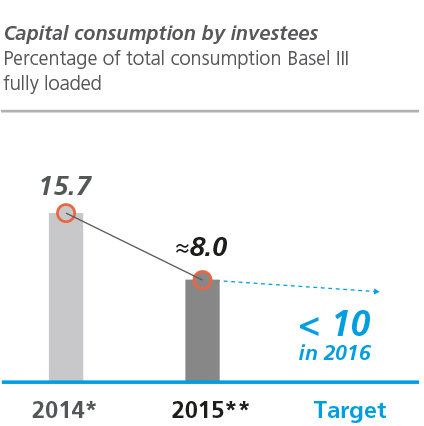

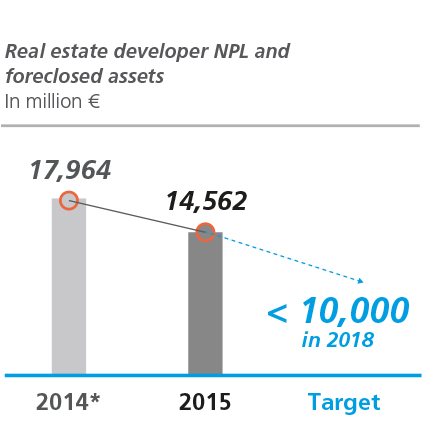

LINE 3 - MANAGE CAPITAL

Objectives and milestones

Objectives and milestones

LINE 4 - DIGITALISATION OF THE BANKING INDUSTRY

Objectives and main milestones

Objectives and main milestones

LINE 5 - TEAM

Objectives and main milestones

Objectives and main milestones

ACCESSIBILITY

SHARE

DOWNLOAD

PRINT

DOWNLOAD

2015

2014

2013

2012

2011

PDF

PDF

Microsite

Microsite

The Principles of the UN Global Compact covered in the page are:

The Principles of the UN Global Compact covered in the page are: