GIVING BACK TO SOCIETY

CaixaBank is a key player in the Spanish economy and works to promote economic growth, private sector productivity, job creation and better living standards for individuals and families. The bank‘s healthy earnings and solvency are key to enabling it to safeguard jobs, acquire products and services from suppliers, compensate shareholders and thus help fund the community work pursued by the ”la Caixa” Banking Foundation and its Welfare Projects.

IMPACT OF OUR ACTIVITY

CaixaBank contributes to the country‘s economy through its financial activities and the effect of its expenditure on supplies, its employees and suppliers‘ employees when they spend their salaries, the dividends to its shareholders and the production activity of the businesses and self-employed professionals it finances. The bank believes it is duty-bound to contribute to public finances, based on a fiscal policy underpinned by principles of responsibility, prudence and transparency.

The bank is also an important source of job creation:

- Directly, with its more than 32,242 employees.

- Indirectly, through the multiplying effect of its purchases from suppliers.

- Induced, as a result of its employees and suppliers purchasing products and services and from financing its customers.

The bank is also involved in the Incorpora programme of the ”la Caixa” Foundation, which works towards the financial inclusion of individuals at risk of exclusion.

Contribution to the Spanish economy

6,985

CaixaBank‘s contribution to Spanish GDP (direct and indirect)

million €

(0.90% of GDP)

1,429

Purchases from suppliers

million €

(97% Spain)

2,520

Tax contribution

million €

Jobs creation

43,041

Jobs generated indirectly

via purchases from suppliers

109,000

Job opportunities

generated through Incorpora

(since 2006)

For additional information

BOOSTING ECONOMIC ACTIVITY

In 2015 the bank continued working to provide support and cover the needs of the business sector and families and to promote entrepreneurship and innovation.

Self-employed professionals and businesses

CaixaBank‘s value proposition includes a wide range of customised products and services for self-employed professionals and small, medium and large enterprises.

The bank has the largest market share of companies and in 2015 its market shares even improved (the market share for lending rose 85 basis points to 13.9% and was up 28 basis points for factoring and reverse factoring, reaching 19.8%).

CaixaBank customers

57.4%

of Spanish companies

32.7%

of Spanish self-employed

professionals

Financing for companies

211,088

new loans arranged

(+12% vs. 2014)

77,153

million granted

(+26% vs. 2014)

Financing for self-employed professionals

80,268

new loans arranged

(+14% vs. 2014)

1,719

million granted

(+17% vs. 2014)

One of the bank‘s strategic commitments is the mobilisation of its sales force, which has more than 13,500 Smart PCs and other solutions that facilitate access to niche markets.

—CaixaNegocios, for self-employed workers, businesses, freelance professionals and micro-companies: with 380,800 new clients (+23% vs. 2014) and €94,000 million in turnover.

— AgroBank, for the agriculture, livestock and fishing sector: with 47,000 new customers (+67% vs. 2014) and a turnover of €15,118 million.

For additional information

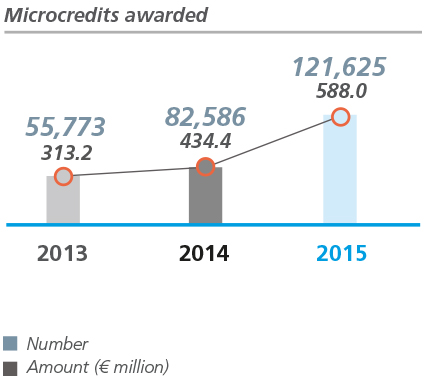

MicroBank

MicroBank, the Group‘s largest social banking arm specialised in microfinance in Europe, serves those population segments whose financial needs are not generally covered, whether they are entrepreneurs, micro-companies or families.

It has been in operation since 2007, through CaixaBank‘s branch network, to boost production, job creation, self-employment, personal and family development, and financial inclusion.

The bank has a wide range of microcredits for all needs:

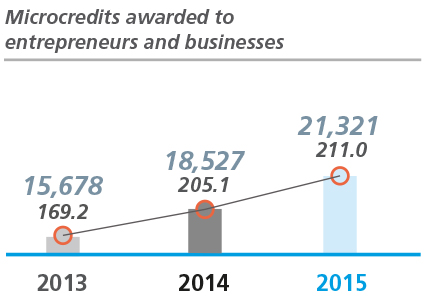

- For self-employed professionals and micro-companies: Entrepreneurs and Business Microcredit and Business ecoMicrocredit.

- For entrepreneurs at risk of social exclusion: Social Microcredit, with the collaboration of 566 entities that provide advisory services for self-employment projects.

- Microcredits for individuals and families: Personal and Family Microcredit, Personal ecoMicrocredit and Erasmus+ Master Loan.

- For social enterprises: Social Enterprise Loan.

- Pledges: Secured microcredits.

21,321

Jobs created

thanks to the microcredits for entrepreneurs and businesses awarded

EmprendedorXXI Prizes

The EmprendedorXXI Prizes, created in 2007, identify, recognise and assist newly-created and innovative Spanish businesses with high potential for growth.

The prizes are awarded in conjunction with ENISA, the Spanish Ministry for Industry, Energy and Tourism‘s innovation body.

There are two categories:

- Creces [You Grow], for companies that have been on the market for between two and seven years.

- Emprendes [You Set Out], for start-ups (less than two years in operation).

There were 737 participants in the ninth edition of these awards.

For additional information

PDF

PDF

Microsite

Microsite

The Principles of the UN Global Compact covered in the page are:

The Principles of the UN Global Compact covered in the page are: