Key strategies /

LEAD THE DIGITALISATION OF THE BANKING INDUSTRY

STRATEGIC OBJECTIVES

- Further extend our leadership in multi-channel and mobile banking.

- Capitalise on the opportunities presented by the digital revolution to provide an enhanced service and strengthen management capacity across all areas of the organisation.

2015 MILESTONES

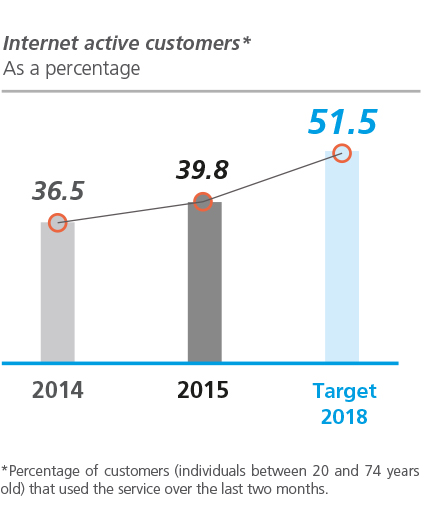

CaixaBank is continuously working to maintain its leadership in digitalisation, which remains a priority in this Strategic Plan. In 2015, our penetration of online banking (web and mobile) among customers increased to 40%, with increased digital contracting, particularly for mutual funds, pension plans and consumer credit.

We are continuously innovating in our customer relationships, through new devices and functionality. Highlights include the roll-out of Wall (our Línea Abierta communication mechanism for customers and their managers), our new CaixaBank Pay mobile payment service and the “Mis finanzas” smart manager, and the launch of imaginBank in January 2016.

Transactions are continuing to migrate to electronic channels: at year end, Línea Abierta accounted for 81% of transactions, including cash withdrawals and transfers. This allows branches to concentrate more of their time on providing advice, adding greater value.

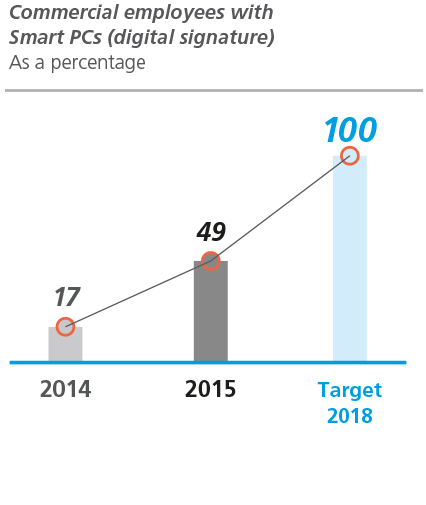

Mobility is another pillar of our digitalisation strategy. At year end, half of our commercial staff were using mobile terminals (Smart PCs), enabling them to contract products with customers outside the branch using a digital signature.

As part of the project to incorporate Big Data as a commercial and management tool, we are running projects to enhance quality and security, increasing sales through a more thorough understanding of our customers, reducing costs and optimising processes.

These efforts are continuing to reap recognition and awards worldwide. CaixaBank was rated the top mobile bank in the world by Forrester Research, and the most innovative bank for mobile payments in the Retail Banker International awards.

Key monitoring metrics

STRATEGIC PRIORITIES 2016

- To increase leadership of internet (fixed and mobile) banking penetration with customers.

- To increase absorption of transactions and sales through digital channels.

- To increase the number of branches with new technological architecture.

- To continue developing Big Data tools and expert models.

For additional information

PDF

PDF

Microsite

Microsite

The Principles of the UN Global Compact covered in the page are:

The Principles of the UN Global Compact covered in the page are: