Key strategies / Quality and reputation

THE CUSTOMER, IN THE CENTRE

The essence of CaixaBank is to serve people and drive economic and social development in the regions in which it has a presence. We are therefore working to be a leading bank in terms of quality of service, trust among customers, social commitment and long-term vision.

CONVENIENT BANKING

The bank is committed to being accessible and close to its customers through its extensive branch network and the other channels available to them. CaixaBank professionals also show empathy and actively listen to customers to become aware of and try to resolve any of their concerns.

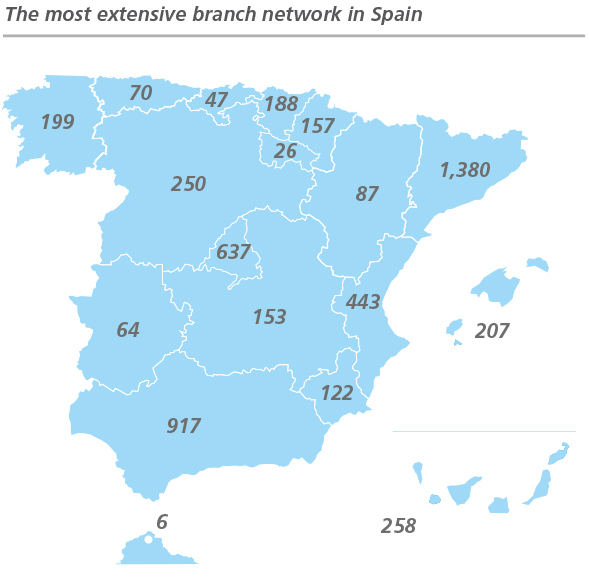

The bank has the largest number of offices in Spain and the most extensive ATM network, and is a leader in online and mobile banking, with the largest number of active digital customers in the country.

100%

Presence in cities with more than 25,000 residents

14,500

Advisory specialists

10,200

Employees with mobile equipment

It has a specialised advisory model and a large sales team of specialised professionals and a growing number of mobile terminals that provide service to customers outside of the branches.

The bank is committed to transparent and fluid communication both internally and with customers, shareholders and other stakeholders.

It facilitates access to its products and services for as many people as possible:

- A broad product offering, differentiated according to each type of market segment.

- Driving financial inclusion through MicroBank, the Group‘s social banking arm specialised in microfinance.

- Eliminating physical and sensory-based barriers:

— 85% of the branches are accessible and we are working to install access ramps and eliminate any steps.

— Ensure that ATMs are accessible for use by everyone.

— Follow the Web Accessibility Initiative‘s AA level guidelines.

For additional information

EXCELLENT SERVICE

Quality of service, both in customer relations and its internal processes, is one of the bank‘s values and its primary strategic goal as well as one of its competitive levers.

CaixaBank follows extremely demanding quality guidelines that are based on trust, proximity, efficiency and continual improvements. To that end, the bank is committed to providing personalised attention, focusing on specialisation and offering a wide range of products and services.

EFQM European Seal of Excellence for its management model

CaixaBank adopted the EFQM (European Foundation for Quality Management) model in order to continuously improve its business management.

- Progress during the year in applying the model and preparing to renew the seal in 2016 and consolidate the 600-point level obtained in the last renewal.

- The only Spanish financial institution to be a finalist in the EFQM Good Practice Competition 2015: MicroBank obtained second place in the field of job creation through microcredits.

We listen to our customers

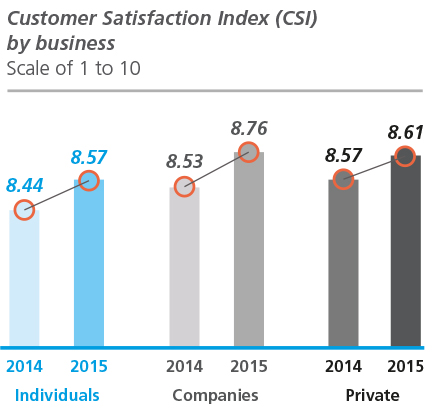

CaixaBank promotes an active dialogue and direct contact with customers and professionals. Among other initiatives, the bank regularly consults the level of customer satisfaction and their recommendations on the service received.

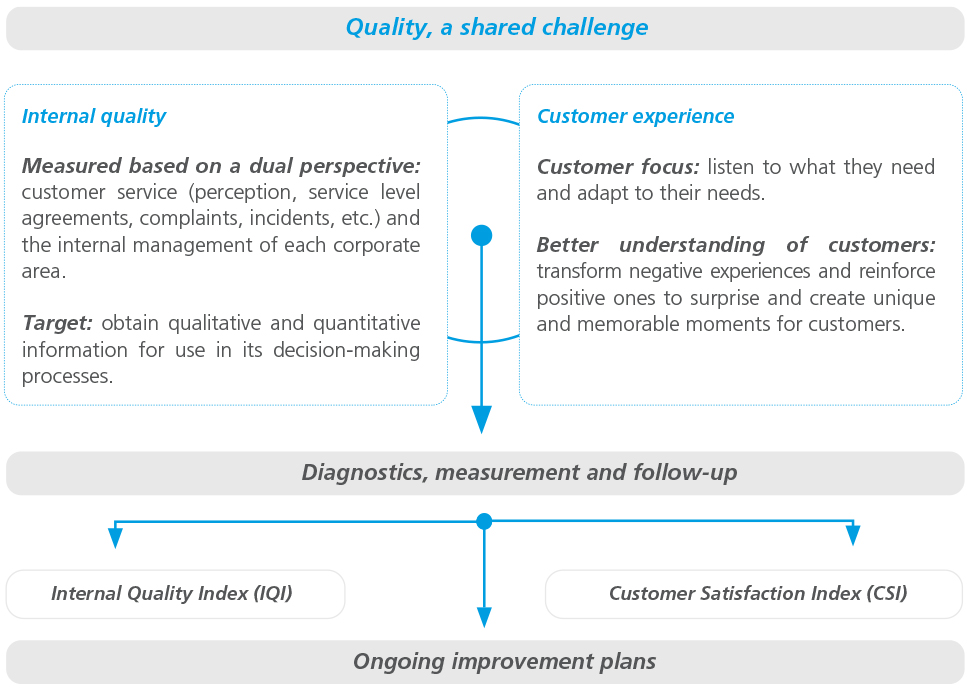

With the information obtained from customer surveys (focus groups, interviews and questionnaires), two strategic indices were prepared for each of CaixaBank‘s businesses:

- The Customer Satisfaction Index (CSI), an internal service quality indicator.

- The Net Promoter Score (NPS), which measures the percentage of customer recommendations for CaixaBank.

Based on this feedback, improvement plans are designed to step up excellence in the service in question.

CUSTOMER SERVICE

Claim management is a key element in customer relations. By actively listening to customers, their latent needs can be analysed and transformed into opportunities for improving the bank‘s business processes.

At CaixaBank, queries, complaints and claims are managed through the channels available and responses are given quickly on a case-bycase basis in order to “avoid, resolve and improve”.

The communication channels at our customers‘ disposal are:

- The bank‘s branches and centres, which manage each incident on a case-by-case basis.

- The Customer Service Office (letters, toll-free customer service line and contact form on the website), as a customer-oriented service.

- The twitter account @CABK_Responde

- The Mortgage Customer Advisory Service (SACH) is a unique service in the Spanish financial sector, which specialises in assisting customers, through a toll-free customer service line, with any dealings initiated regarding their primary residence.

- Customer Service and the Customer Ombudsman, as a step prior to the Bank of Spain and the Spanish securities market regulator (CNMV).

For additional information

A TRUSTWORTHY BANK

CaixaBank has inherited a 100-year-long tradition of social commitment and contribution to the socio-economic development of the country and aspires to be perceived as a responsible bank.

Ethics and good governance are essential for the bank. CaixaBank has internal codes of conduct and forms part of international alliances for the collective advancement of sustainable practices. Highlights in 2015 include the publication of the Corporate Social Responsibility Policy and the bank‘s adhesion to the Code of Best Tax Practices and the Green Bond Principles.

Main actions in 2015

Over 465,000 assistance measures for families with mortgage loans and undergoing financial difficulties since 2009

Promote retirement planning, long-term savings and financial education

- CaixaBank manages 22.6% of Spaniards‘ savings insurance and 21.5% of their pension plans.

- VidaCaixa, the Group‘s pension plan manager, has the highest number of direct pensions deposits after the Social Security system.

- 180 Caixafu[tu]ro events organised, to assist customers in planning for their retirement with almost 18,000 attendees.

- 1,642 attendees at 100 financial training workshops aimed at vulnerable groups.

- 16 training courses in economics and markets for 1,306 shareholders.

Collaborate with the ”la Caixa” Foundation to disseminate and roll out its programmes

- 23,626 job opportunities for people who were at risk of exclusion generated through Incorpora.

- 2.5 million children vaccinated since 2009 through collaboration with Gavi, the Vaccine Alliance.

- 33,084 rental flats available at below-market prices.

- 7,677 participants in the Corporate Volunteering Programme, with 221,795 beneficiaries.

Participate in the fight against climate change

- €5.7 million granted in ecoLoans in 2015.

- 3,247 MW in installed capacity in the 19 renewable energy projects financed during the year.

- World leader, with the highest rating in the CDP index, which assesses the transparency and actions of companies with regard to climate change.

For additional information

PDF

PDF

Microsite

Microsite

The Principles of the UN Global Compact covered in the page are:

The Principles of the UN Global Compact covered in the page are: