Key strategies /

CUSTOMER FOCUS: BE THE BEST BANK IN TERMS OF BOTH QUALITY AND REPUTATION

STRATEGIC OBJECTIVES

- To stand out among all financial institutions for superior customer satisfaction.

- To consolidate CaixaBank‘s reputation as the standard-bearer for responsible and socially-committed banking.

- To be a benchmark for corporate governance.

2015 MILESTONES

In order to set ourselves apart as the bank with the highest customer satisfaction, CaixaBank is creating global experience maps to give it deep insights into the needs and expectations of its customers. It is using this analysis to foster initiatives to enhance the customer experience and their emotional loyalty to the bank.

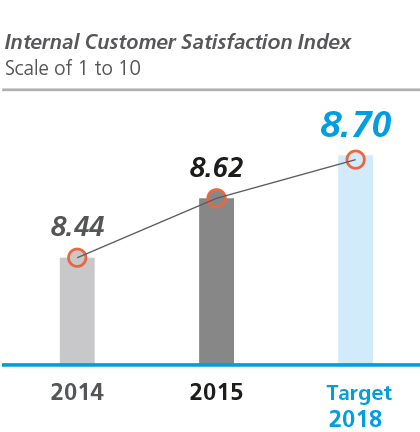

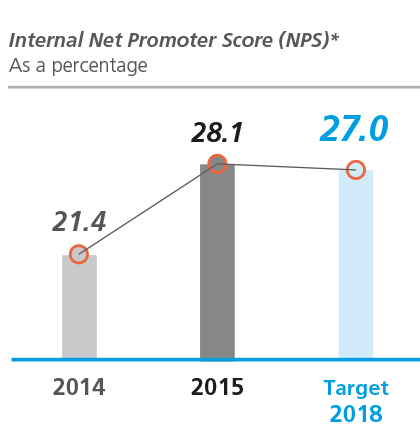

2015 saw very positive developments in internal and external indicators of quality perception. For example, the Net Promoter Score (NPS) improved by more than six points, consolidating the upward trend in customer recommendations for the bank. CaixaBank also achieved the first AENOR certification in Europe for quality of service in business banking.

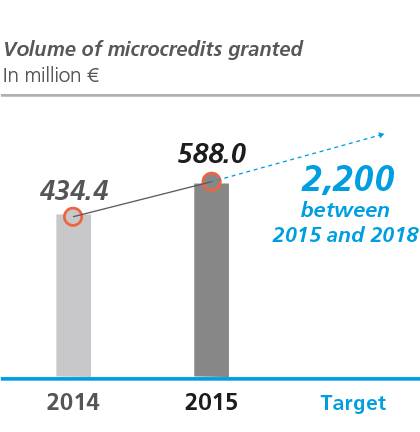

In terms of its reputation, the Group renewed its presence in the World and Europe Dow Jones Sustainability Indexes (DJSI). This bolsters its position as one of the leading banks for corporate responsibility. The bank continued to foster financial inclusion through the most extensive branch network in Spain, the granting of microcredits and the launch of financial education programmes.

During the year, CaixaBank ceased to apply the vast majority of floor clauses in its mortgage loan portfolio for individuals. Most of these contracts stemmed from entities integrated into CaixaBank over recent years.

The initiatives launched to buttress corporate governance − another pillar of the Plan − resulted in improved external perception compared to other international companies and banks. These include, for example, the DJSI and the Institutional Shareholder Services (ISS) scores in this field.

Key monitoring metrics

* Difference between the percentage of customers who would recommend the entity compared to detractors.

STRATEGIC PRIORITIES 2016

- To deepen knowledge of customers through global experience maps.

- To develop and implement new quality metrics.

- To achieve further certification of quality and internal processes.

- To continue adopting best practices for social responsibility and corporate governance.

For additional information

PDF

PDF

Microsite

Microsite

The Principles of the UN Global Compact covered in the page are:

The Principles of the UN Global Compact covered in the page are: