KEY STRATEGIES

CaixaBank is rolling out the 2015-2018 Strategic Plan with the objective of being a leading financing group in Spain with a global outlook, recognised for its social responsibility, quality service, financial soundness and innovative capacity. Significant progress was made during the first year of the Plan towards reaching its strategic objectives.

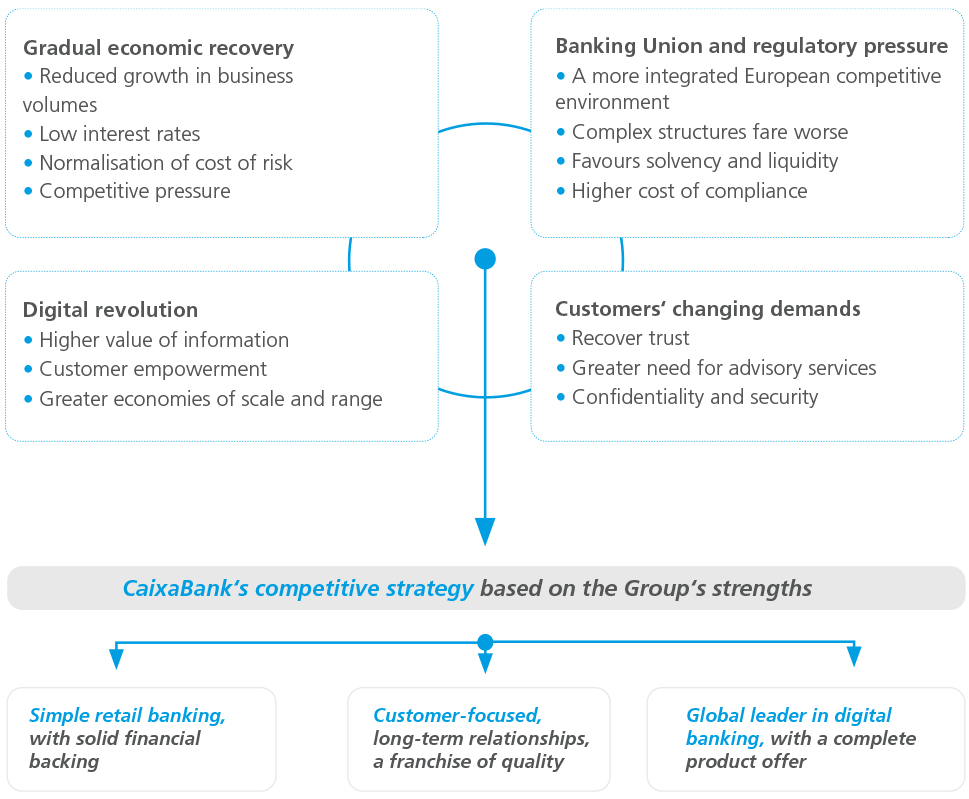

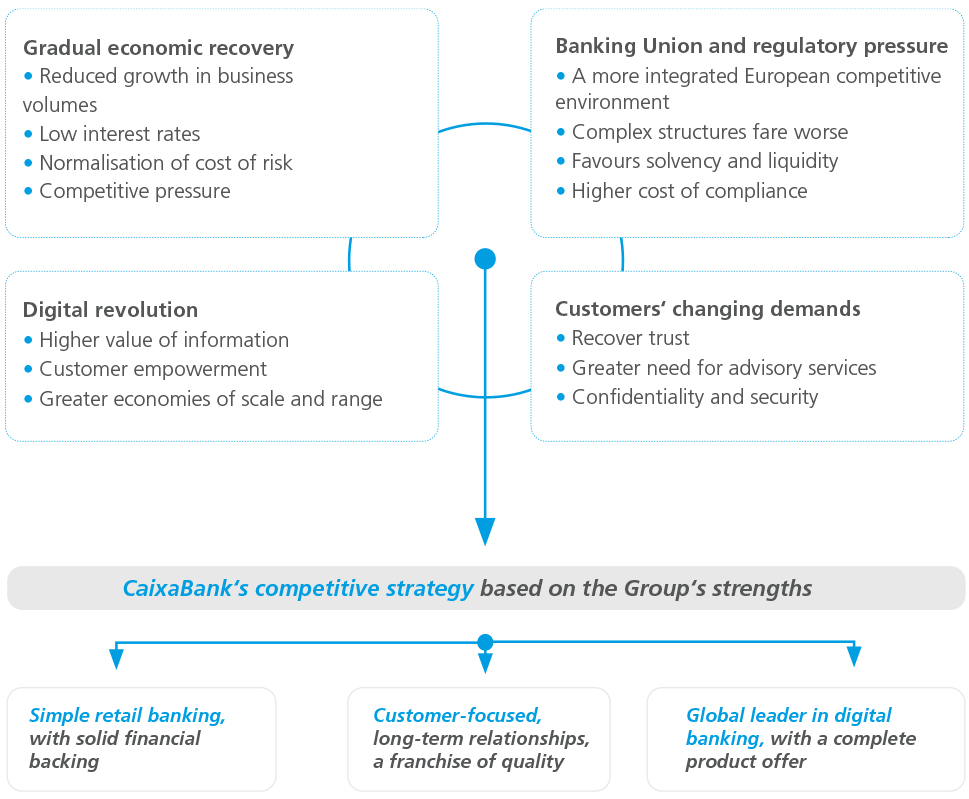

ECONOMIC AND BANKING LANDSCAPE

The gradual recovery of the Spanish economy was confirmed in 2015, with the highest growth rate for economic activity (3.2%) since 2007. However, the deleveraging process continued, albeit at a more modest rate. In Europe, the European Central Bank‘s expansive policy has kept interest rates at historically low levels, while the deployment of the banking union is redefining the competitive and regulatory framework. Although the reputation of Spanish and European banks has improved, the figures are still relatively low. Against this backdrop, banks must obtain sufficient return to allow them to cover the cost of capital, while also anticipating the impact of innovative developments and new technologies in relations with customers.

STRATEGIC PLAN 2015-18 “PREPARED TO LEAD THE SECTOR IN TRUST AND PROFITABILITY”

For the 2015-2018 period, CaixaBank defined five strategic lines after analysing the bank‘s starting point and the opportunities and threats of the current economic environment. In order to ensure the organisation is in line with its strategic guidelines, the Group is implementing various transversal projects and improving key processes with a significant impact on achieving its targets. In addition, both internal and external communication mechanisms have been rolled out to promote the transparency and understanding of the Plan, such as the presentation to the investment community at Investor Day held in March 2015.

Customer focus:

be the best bank in terms of both quality and reputation

Against the backdrop of a loss of trust in financial institutions, CaixaBank intends to set itself apart as the paradigm of a responsible bank committed to its customers and society. The bank must also be a benchmark for good corporate governance, from retail investor services to a culture of control across all processes.

Attain recurring returns above the cost of capital

After preserving its significant financial strength during the recession, CaixaBank is committed to obtaining returns that enable it to pay its shareholders a substantial dividend over time. The gradual recovery of the Spanish economy and the growth in turnover will contribute to an improvement in results.

Actively manage capital

A consistently high level of solvency must be supplemented by an optimal use of capital that allows for a decrease in consumption by real estate and investee businesses in relation to banking activity.

Lead the digitalisation of the banking industry

Thanks to the opportunities presented by the digital revolution, the bank is working towards extending its leadership in multi-channel and mobile banking. The development of Big Data should also strengthen the operational efficiency and commercial effectiveness of the organisation through a greater use of available information.

Have the best prepared and most dynamic team possible

The profound changes in the banking sector and in customers‘ demands require having the best prepared and most dynamic team possible, which gives rise to the need to shore up training in key professional skills, strengthen the culture of performance-based advancement and diversity, and consolidate a decentralised management model, which strengthens the empowerment of people.

PDF

PDF

Microsite

Microsite

The Principles of the UN Global Compact covered in the page are:

The Principles of the UN Global Compact covered in the page are: